Sep ira calculator growth

Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. Enter your name age and income and then click Calculate The.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Solo 401k Plans By Nabers Group Self.

. The SIMPLE IRA calculators final result is a forecast of how much your SIMPLE IRA account will increase over the next five years. Create a more efficient retirement and guarantee income with a DPL solution. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

When you purchase life and retirement. You cant simply multiply your net profit on Schedule C by. W-2 income would come from the business payroll records.

This rate is not adjusted for inflation. Simplified Employee Pension Plans SEP IRAs help self-employed individuals and small-business owners get access to a tax-deferred benefit when saving for retirement. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Ad Discover the Benefits of a Commission-Free Annuities in the Financial Plan. Ad We leverage our financial knowledge industry experience technology to finance SMBs.

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Save for Retirement by Accessing Fidelitys Range of Investment Options. Stocks using benchmark indexes such as the SP 500 Index which is about 10.

It is mainly intended for use by US. Get weekly automated payouts in your bank account based on your active MCA deals. With our IRA calculators you can determine potential tax.

Consider the costs of a conversion. For comparison purposes Roth IRA and regular. Traditional IRA Calculator Details To get the most benefit from.

Employer contributions for each eligible employee must be. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Sep ira calculator growth Jumat 02 September 2022 Edit.

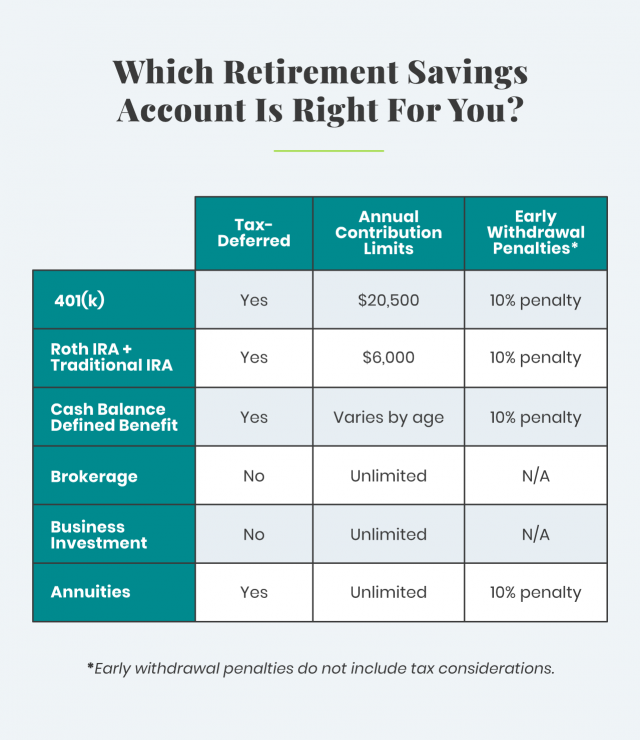

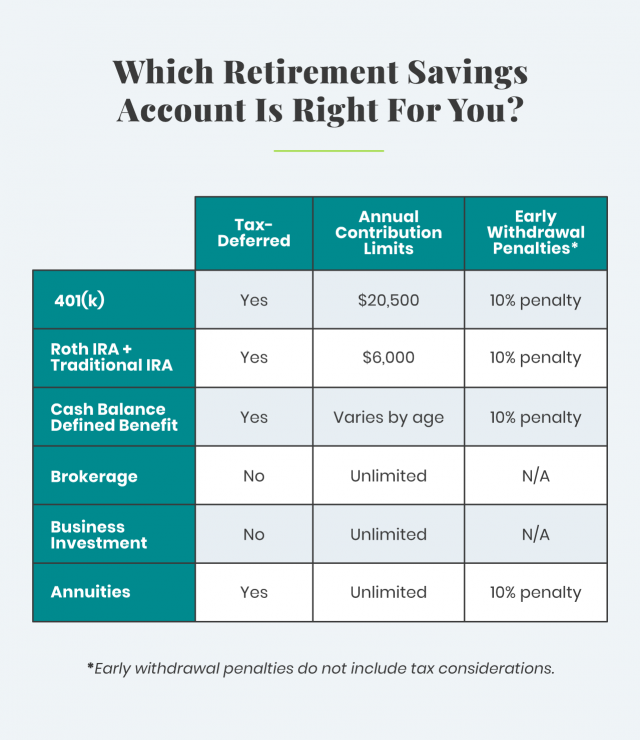

Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. 2 days agoSEP IRA contributions for 2022 can be up to the lesser of 61000 or 25 of your compensation while contributions to a traditional or Roth IRA are capped at 6000 annually. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future. Titans calculator uses the historical average growth rates for US.

SIMPLE IRA 5-Year Growth Forecast. When to Use a SEP IRA Calculator This free SEP IRA contribution calculator is an ideal tool if youre thinking about using a SEP and want to know how much youll be able to contribute. Based only on the first 305000 of compensation for 2022 290000 for 2021 285000 for 2020 The same.

Save for Retirement by Accessing Fidelitys Range of Investment Options. How to Calculate Amortization Expense. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

SEP or SIMPLE IRA or a defined. This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to forecast the future growth of your IRA as well as the. This formula works to determine employees allocations but your own contributions are more complicated.

How to Calculate Cost of Goods. How to Calculate Self-Employment Tax. And so are we.

Fidelitys retirement calculators can help you plan your retirement income savings and assess your financial health Fidelity Retirement calculators tools Our calculators tools will help. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP.

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Sep Ira For An S Corp The 1 Contribution Guide For 2022

Ira Calculator See What You Ll Have Saved Dqydj

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

How A Custodial Ira Can Give Your Child A Head Start On Retirement Savings T Rowe Price

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

What Is A Sep Ira Sep Ira Contribution Limits Rules Guidedchoice

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

How Much Can I Contribute To My Self Employed 401k Plan

401 K Alternatives To Save For Your Retirement

Portfolio Retire Before Dad

Roth Ira Calculators

Simple Ira Contribution Limits In 2022 Wealth Nation

Simple Ira Contribution Limits In 2022 Wealth Nation

Contributing To Your Ira Start Early Know Your Limits Fidelity